When you buy or sell a motor vehicle in Arkansas, you need a Bill of Sale. This serves as a legal receipt from the seller to the buyer documenting both the change in ownership and the purchase price. The state of Arkansas provides a state-approved printable Bill of Sale.

The following information should appear on the Arkansas Bill of Sale Form:

- Name and complete address of the seller.

- Name and omplete address of the buyer.

- Complete vehicle description, including Vehicle Identification Number (VIN), make, model, year.

- Vehicle odometer reading at the time of sale.

- The price paid and date of sale.

- Both the seller’s and the buyer’s signatures.

Arkansas Bill of Sale Form

Click here to download the state-approved printable Arkansas Bill of Sale Form – Form 10-313.

If you want to apply for a sales tax credit use this fillable PDF form: Arkansas Bill of Sale – Credit for Vehicle Sold. This form will be used for a vehicle claimed as a tax credit toward the purchase of a replacement vehicle.

You should know also that a Bill of Sale does not replace a title transfer. So a Bill of Sale is a document that proves that a transaction took place and shows the details of the buyer. So you’ll have to complete also a title transfer during any sale of a motor vehicle between two parties in the state of Arkansas.

The Arkansas Office of Motor Vehicle (OMV) will accept a completed title in place of a Bill of Sale Form but a Bill of Sale is required if the seller wants to apply for a sales tax credit or the seller has no room on the current title to sign the vehicle over to the buyer.

Whether you use a Bill of Sale Form or the back of the car title you have to record the odometer reading.

You must complete a Bill of Sale Form if you want to apply for a sales tax credit. A sales tax credit is only applicable if you plan to register a newly acquired motor vehicle to replace the vehicle you sold within 45 days before or after you acquire the vehicle. For example, you cannot get a sales tax credit for a motor vehicle you bought last year, or one you plan to buy in a few months.

But if you’re not required to complete a Bill of Sale Form having one helps you keep important transaction details.

Selling a Vehicle in Arkansas

As a seller you are required to properly complete the title and hand over the title to the buyer because this is the proof that the buyer now owns the vehicle, and also releases you from liability. The seller should remove the license plate because the plates stay with the person, not on the motor vehicle.

Also the seller can apply for the sales tax credit 45 days before or after buying another vehicle (if applicable).

Buying a Vehicle in Arkansas

As a buyer when you title and register a used car, you will need a completed title. You can supplement, but not replace, the title with a completed Bill of Sale Form. So don’t accept only a Bill of Sale in place of a title!

The Arkansas Office of Motor Vehicle will accept a completed title instead of a Bill of Sale Form, as long as the title includes all the required information (see above).

As a buyer check the seller’s identification documents and make sure you and the seller have properly completed the title. Make sure everyone who needs to sign the title does so. Two names separated by “OR” means either party can sign the title, but “AND” and “AND/OR” means both parties must sign the title!

The buyer has 30 calendar days from the date of purchase to title and register the motor vehicle.

The Arkansas Office of Motor Vehicle doesn’t require a salvage vehicle Bill of Sale for reconstructed vehicles, but it will ask you where you obtained every part you used to reconstruct the vehicle. Before you can title and register a salvaged vehicle, you must complete an Affidavit of Reconstruction for a Salvage Motor Vehicle. So it’s a good idea to print the Affidavit of Reconstruction of Salvage Motor Vehicle and keep track off all the information as you purchase and replace the parts for your reconstructed motor vehicle.

How to complete the Arkansas Bill of Sale Form

The Arkansas Bill of Sale Form 10-313 is composed of nine sections. Below you’ll learn how to complete this state-approved form:

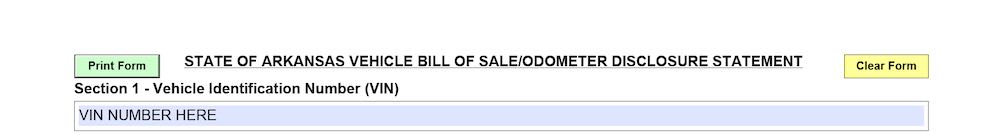

Section 1

In the first section complete the VIN or Vehicle Identification Number of the vehicle:

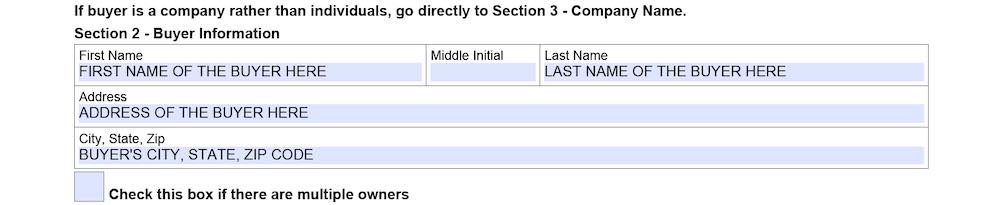

Section 2

In the second section complete the Buyer information. Complete first the full name of the buyer. The buyer’s name must be PRINTED. This means to use only Capital Letters to write BUYER’S NAME. Next complete the buyer’s address, buyer’s city, state, ZIP code, and check the box ONLY if there are multiple owners:

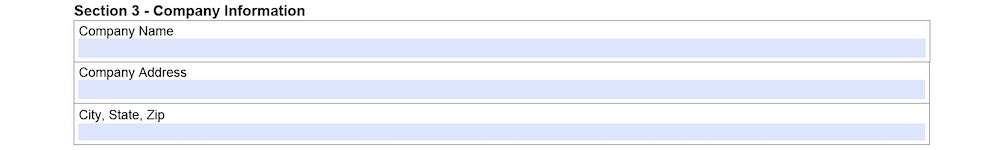

Section 3

The third section contains the buying company information, if the buyer is a company:

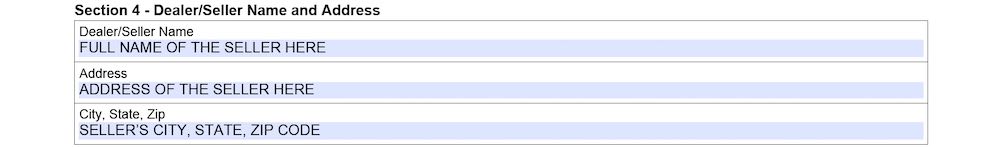

Section 4

The fourth section contains the seller information. So complete first the full name of the seller. The name must be PRINTED. This means to use only Capital Letters to write SELLER’S NAME. Then complete seller’s address, seller’s city, state, and ZIP code:

Section 5

In the fifth section complete the purchase date of the vehicle:

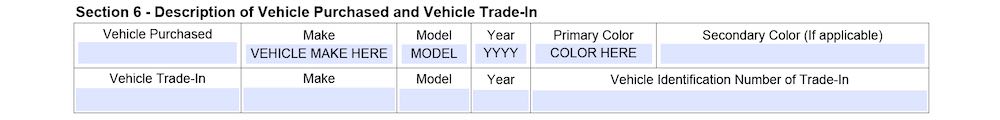

Section 6

In Section 6 complete the vehicle information. Here you need to complete the Make, Model, Year, and Color:

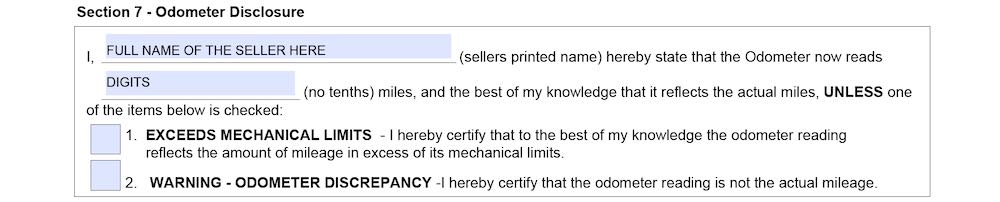

Section 7

At Section 7 you have to complete the Odometer Disclosure Statement. First complete the full PRINTED name of the seller. Then complete the Odometer Reading at the time of transfer (use only digits, no tenths). Lastly only if it’s the case check either 1. EXCEEDS MECHANICAL LIMITS or 2. WARNING – ODOMETER DISCREPANCY:

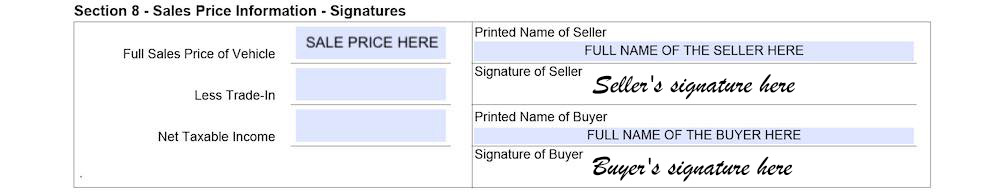

Section 8

In the 8th section complete first the full sales price of the vehicle. Then complete the PRINTED name of both the seller and the buyer and their signatures:

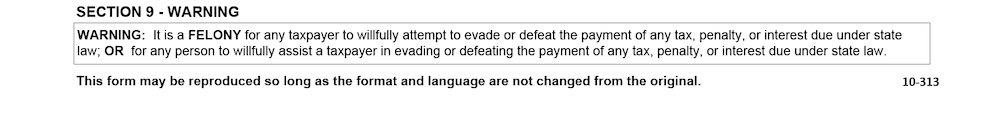

Section 9

The last section is a legal warning regarding any attempt for any taxpayer to willfully evade or defeat the payment of any tax:

Please note that you can complete this Bill of Sale form by hand. However don’t forget to use a pen and not a pencil. If you are filling out this form on your device (phone, tablet, computer) this form is a fillable PDF that works best with Adobe Acrobat Reader.

View more details about the Arkansas Office of Motor Vehicle

For more information go to Arkansas Department of Finance and Administration – Office of Motor Vehicle

The Arkansas Department of Finance and Administration – Office of Motor Vehicle primary responsibilities are to administer the State of Arkansas vehicle registration, title, and lien perfection laws. The Office establishes and maintains the vehicle registration, title and lien perfection operating procedures used in the State Revenue Offices.

The Office also examines all title applications submitted in State Revenue Offices for accuracy and compliance with state law, authorizes title production for all approved title applications, maintains the state repository for vehicle registration, title and lien records and administers the International Registration Plan, an agreement between the United States and Canada for the apportionment of registration fees for trucks and truck/trailer combinations engaged in the interstate transportation of goods and materials.