In the State of Georgia when you buy or sell a vehicle, you must complete a Bill of Sale. This serves as a legal contract between the buyer and the seller documenting the change in ownership. A Bill of Sale provides evidence that a transaction between the buyer and seller has taken place and that the odometer reading has been declared by the vehicle’s seller and acknowledged by the vehicle’s purchaser. The State of Georgia has some legal specific requirements about what a Bill of Sale must contain.

The following information should generally appear on the Georgia Bill of Sale Form:

- Name of the seller and complete address of the seller – a P.O. box is not acceptable!

- Name of the buyer and complete address of the buyer – a P.O. box is not acceptable!

- Complete vehicle description, including Vehicle Identification Number (VIN), make, model, year, series number and body type.

- Vehicle odometer reading at the time of sale.

- Lienholder created at time of resale.

- Date of lien, if applicable.

- Date of sale.

- Signature of the seller and the buyer.

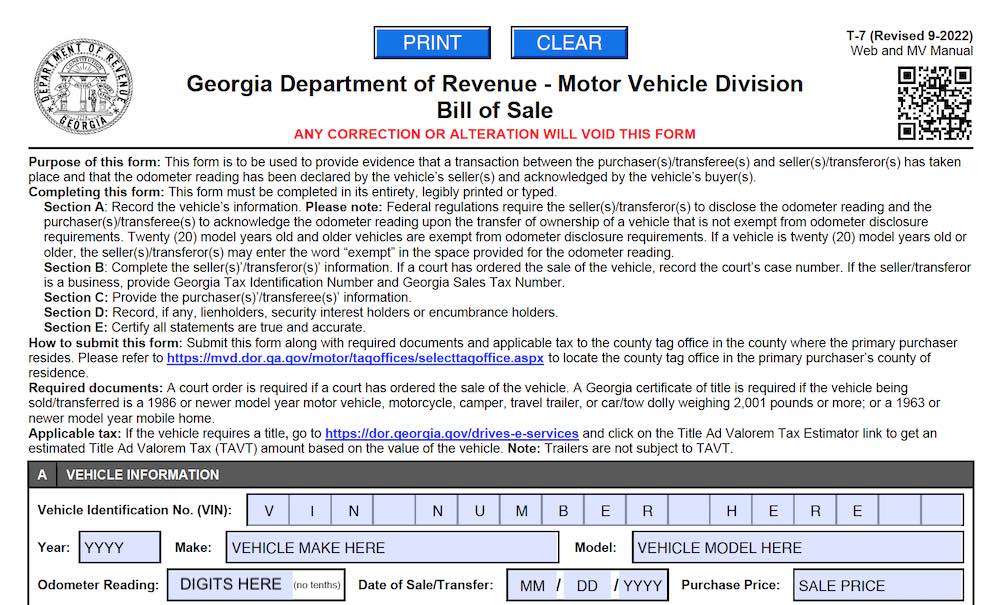

Georgia Bill of Sale Form

The Georgia Motor Vehicle Division (MVD) offers an online, printable Georgia Bill of Sale Form – Form T-7 (Revised 9-2022).

You will need a Bill of Sale Form to get a Georgia title and registration and to apply for a license plate. You cannot use a Bill of Sale to transfer the ownership without a Georgia Certificate of title. Unless your vehicle does not require a title and in this case you should use an original Form T-22B Certification of Inspection.

Now the law requires that you complete an Odometer Disclosure Statement form when you transfer a vehicle that is a model year 2011 or newer and below 16,000 pounds. So if you exempt the seller/transferor may enter the word “exempt” in the space provided for the odometer reading in the Bill of Sale Form.

In the situation of an odometer discrepancy the seller/transferor and the purchaser/transferee may use this form to execute statements of facts when there is an odometer discrepancy reflected on documents pertaining to the transfer of ownership of a vehicle: Odometer Discrepancy Affidavit – Form T-107.

In case you need a notarized Odometer Discrepancy Affidavit by a commissioned notary public use this form, instead of the one above: Odometer Discrepancy Affidavit – Form T-107A.

As a seller you should give the vehicle title to the buyer. Particularly the title is required to complete the registration. So make sure all information matches, including the vehicle identification number and odometer reading.

As a buyer you should never leave without the vehicle title after the transaction. Also the buyer should verify if the vehicle description is accurate and check the make, model, year, body style and color. Although the buyer should check also that the odometer reading and VIN are the same on the vehicle as recorded on the title.

How to complete the Georgia Bill of Sale Form

The Georgia Bill of Sale Form T-7 is composed of five sections. Below you’ll discover how to complete this state-approved form:

Section A

The first section contains instructions to correctly complete this form and the vehicle information. First complete the VIN or Vehicle Identification Number, Year, Make, and Model. Next complete the odometer reading at the time of transfer (use only digits, no tenths). Lastly complete the date of sale or transfer and the purchase or sale price of the vehicle:

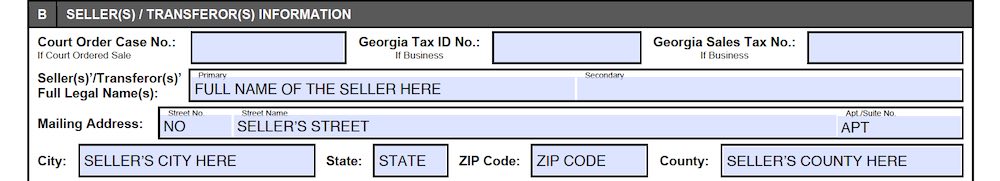

Section B

In the second section you have to complete the Seller(s) information. First complete the full name of the seller(s). The name(s) must be PRINTED. This means to use only Capital Letters to write SELLER’S NAME. Then complete seller’s street address, seller’s city, state, ZIP code, and county:

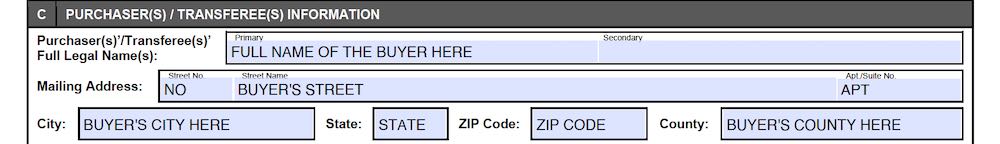

Section C

The third section contains the Buyer information. Complete first the full name of the buyer(s). The buyer(s) name(s) must be PRINTED. This means to use only Capital Letters to write BUYER’S NAME. Next complete buyer’s street address, buyer’s city, state, ZIP code and county:

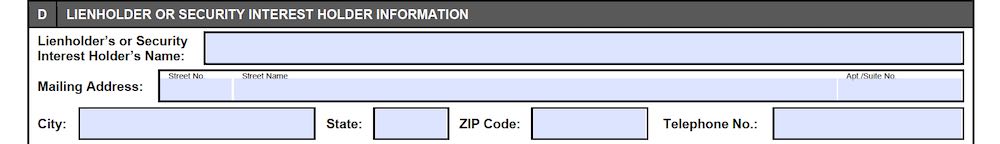

Section D

The fourth section D contains, if it’s the case, the Lienholder or security interest holder information:

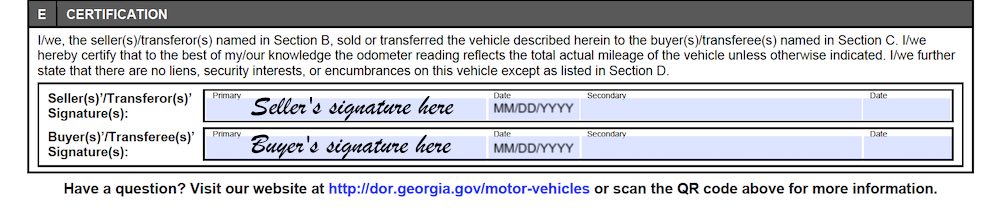

Section E

The last section contains the seller(s) certification. Finally the seller(s) and the buyer(s) need to sign and complete the signing date:

You may complete this Bill of Sale form by hand. However don’t forget to use a pen and not a pencil. If you are filling out this form on your device (phone, tablet, computer) this form is a fillable PDF that works best with Adobe Acrobat Reader.

Discover more about the Georgia Motor Vehicle Division

For more information go to Georgia Department of Revenue – The Motor Vehicle Division

The Department of Revenue was created in 1938 and is the principal tax-collecting agency for the State of Georgia. Furthermore in addition to administering tax laws, the department is responsible for enforcing laws and regulations pertaining motor vehicle tag and title administration.