In the State of Nebraska in a private transaction you must complete a Bill of Sale Form at the time of sale or transfer.

However you don’t have to use a specific or state-approved Bill of Sale form.

The Bill of Sale form provided by the Nebraska Department of Motor Vehicles is just an example.

Moreover a completed Bill of Sale is also a good idea for the seller and the buyer to document a vehicle transaction as a legal safety measure.

The following information should appear on the Nebraska Bill of Sale Form:

- Vehicle details, including Vehicle Identification Number (VIN)

- Odometer reading at the time of transfer

- Vehicle’s purchase price or value

- Name and address of the seller

- Name and address of the buyer

- Seller’s Signature

- Date of sale

- Buyer’s signature

Nebraska Bill of Sale Forms

Below you can download and print our updated Bill of Sale forms for 2024:

Because the example provided by the Nebraska DMV doesn’t include the odometer reading we recommend you to use our updated Nebraska Bill of Sale Federal Form.

However you may also use the Bill of Sale form provided by the Nebraska DMV as a courtesy available below:

Click here to download the Nebraska Bill of Sale Form.

How to complete the generic federal Nebraska Bill of Sale Form

The generic federal Nebraska Bill of Sale is composed of three sections and below you can learn how to complete this form:

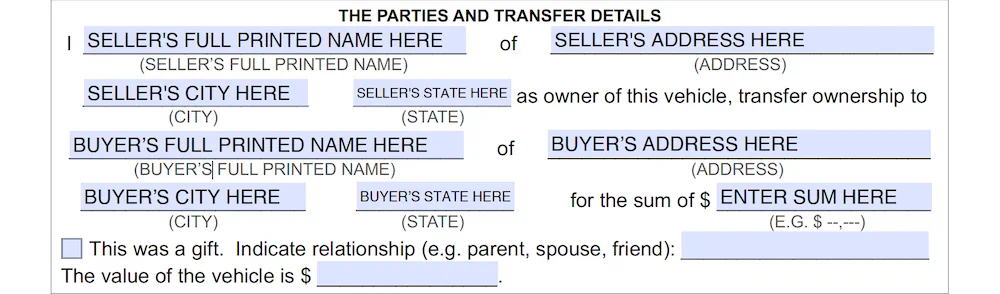

Section 1 of the federal Nebraska Bill of Sale

The first section contains the vehicle information. Here you need to complete the Make, Model, Year, Body type, Color, VIN or Vehicle Identification Number. Also complete here the Odometer Reading at the time of transfer. Use here only digits, no tenths. Then check if this is the Actual Mileage. Or check if the Odometer is in excess of its mechanical limits. If it’s the case you may check if the odometer reading is not the actual mileage:

Section 2 of the federal Nebraska Bill of Sale

In the second section you have to complete first the Seller details. So fill out first the full name of the seller. The name must be PRINTED. This means to use only Capital Letters to write SELLER’S NAME. Then complete seller’s street address, seller’s city and state. Further you need to complete the Buyer information. Start with the full name of the buyer. Again, the buyer’s name must be PRINTED. So this means to use only Capital Letters to write BUYER’S NAME. Additionally complete buyer’s street address, buyer’s city and state. After these details you have to complete the sum of the transfer price of the vehicle or the word GIFT. However if this vehicle is a gift, please indicate the relationship with the person (e.g. parent, spouse, friend) and the value of the vehicle:

Section 3 of the federal Nebraska Bill of Sale

The third section represents the seller’s statement about the details contained in this Bill of Sale Form. Finally complete seller’s signature, date, and buyer’s signature:

Please note that you can fill out this Bill of Sale form by hand. However don’t forget to use a pen with blue or black ink and not a pencil. If you fill out this form on your device (phone, tablet, computer) this form is a fillable PDF that works best with Adobe Acrobat Reader.

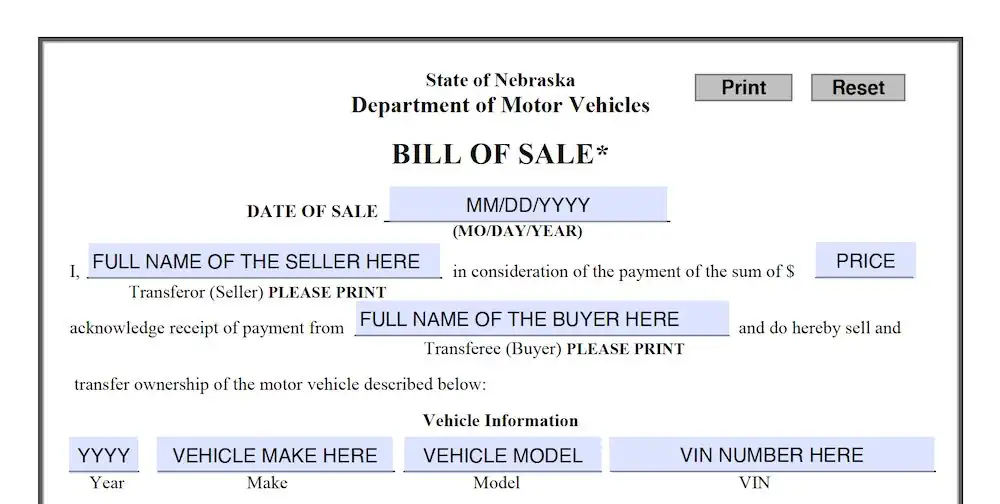

How to complete the state provided Nebraska Bill of Sale Form

The state provided Nebraska Bill of Sale is composed of three sections. Below you can learn how to fill this form:

Section 1 of the Nebraska Bill of Sale

In Section 1 you need to fill in first the vehicle transaction date. Then fill the full name of the seller. The name must be PRINTED. This means to use only Capital Letters to write SELLER’S NAME. Afterwards fill in the sale price of the vehicle. Follwing fill in the full name of the buyer. The buyer’s name must be PRINTED as well.

Lastly fill in the vehicle details. You need to fill in the Year, Make, Model and VIN or Vehicle Identification Number:

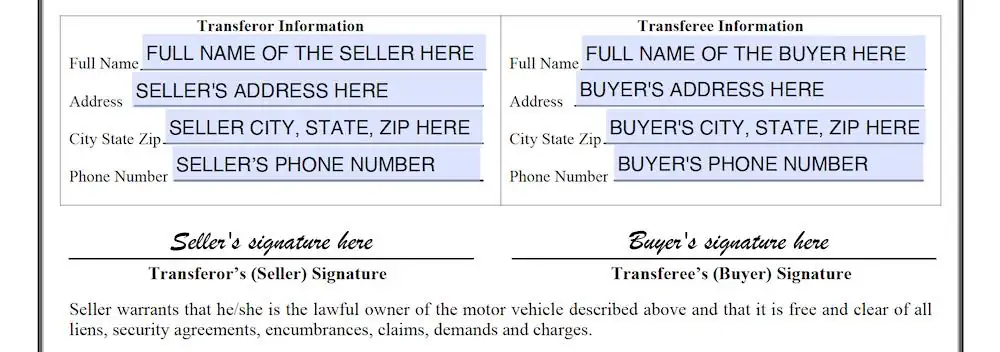

Section 2 of the Nebraska Bill of Sale

At the 2nd section you have to fill in the Transferor’s (Seller) and the Transferee’s (Buyer) information. So in Transferor Information fill in the full name of the seller. The name must be PRINTED. This means to use only Capital Letters to write SELLER’S NAME. After that complete seller’s address, seller’s city, state, ZIP code and phone number. Next move to Transferee Information. Here fill in the full name of the buyer. The buyer’s name must be PRINTED. This means to use only Capital Letters to write BUYER’S NAME. Then fill in buyer’s address, buyer’s city, state, ZIP code and phone number.

Finally fill in seller’s or transferor’s signature and buyer’s or transferee’s signature:

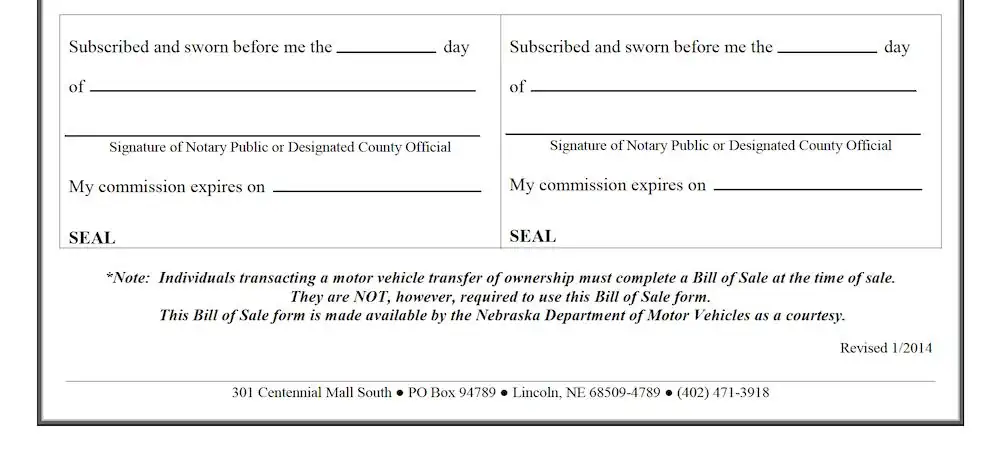

Section 3 of the Nebraska Bill of Sale

You don’t have to fill the last section! This section is reserved for Notary Public or Designated County Official only:

You can fill in this Bill of Sale form by hand as well. But use a pen with black or blue ink and not a pencil! If you fill in this form on your device (phone, tablet, computer) this form is a fillable PDF that works best with Adobe Acrobat Reader.

More about a vehicle transfer in Nebraska

To transfer ownership of a motor vehicle, motorboat, ATV or minibike, all names that appear on the Certificate of Title must sign off in the Seller’s section of the title.

In the case of existing open liens, they must be released by the lienholder and County Official on the face of the title prior to reassignment of the title to the buyer.

Remember to use a good pen to complete the Bill of Sale Form because an illegible form will make it difficult for the Nebraska Department of Motor Vehicles to complete the vehicle’s title transfer.

If the seller doesn’t provide the buyer with a Bill of Sale, a completed Nebraska Department of Revenue Form 6 – Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle And Trailer Sales is valid as well.

However the Form 6 is not available for download and must be obtained by contacting the Nebraska Department of Revenue or any County Treasurer.

Discover more about the Nebraska Department of Motor Vehicles

For more information go to Nebraska Department of Motor Vehicles.

The areas that fall under the jurisdiction of the DVR Division include: Motor Vehicle Titles, Motorboat Titles, Motor Vehicle Registrations, Vehicle Tax Estimator, Registration Fees and Taxes and Motor Vehicle Registration Renewal Notice.

It is important to mention also that there are over 2.3 million vehicles registered in Nebraska.