In the State of North Carolina in a private vehicle transaction a Bill of Sale form is not mandatory.

But, even though this form is not mandatory, you should always complete a Bill of Sale for your personal record and safety.

Moreover, a Bill of Sale is necessary when you purchase a vehicle from a dealership so make sure the dealer provides you with this form.

When you transfer the ownership of a vehicle in North Carolina, the process is very similar to Titling & Registering a Vehicle. So a Title transfer is also mandatory when you transfer a vehicle or when you gift or donate a vehicle.

North Carolina Bill of Sale Form

Below you can find all the details with instructions to complete a Bill of Sale form in North Carolina.

Click here to download and print the North Carolina Bill of Sale Form.

How to complete the North Carolina Bill of Sale Form

This North Carolina Bill of Sale is composed of three sections. So below you’ll see how to fill out this form:

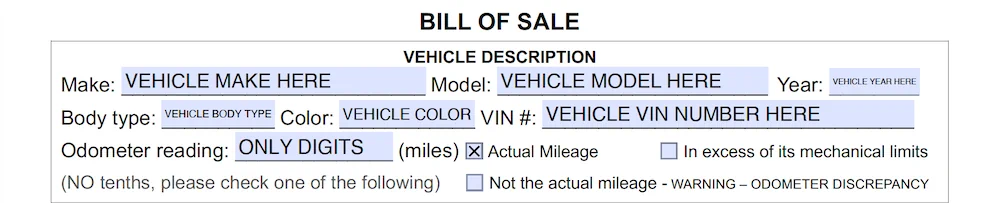

Section 1 of the North Carolina Bill of Sale

Section 1 contains the vehicle information. Here the seller fills out first the Make, Model, Year, Body type, Color, VIN or Vehicle Identification Number. Then completes the Odometer Reading at the time of transfer. Please use only digits, no tenths. Next check if it is the Actual Mileage. Or you can check if the Odometer is in excess of its mechanical limits. Only if it’s the case you can check if the odometer reading is not the actual mileage:

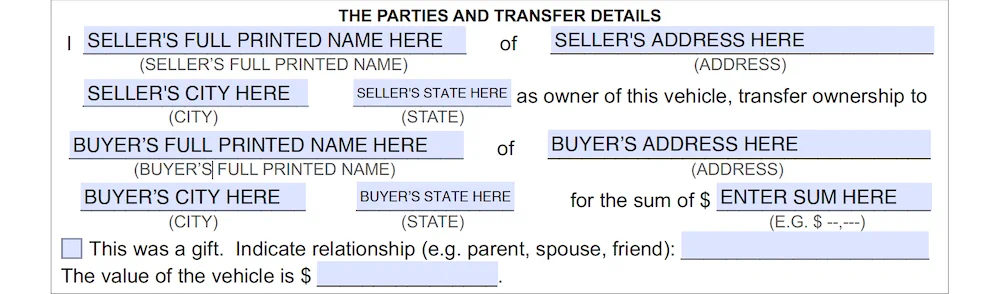

Section 2 of the North Carolina Bill of Sale

In the second section you have to fill out first the Seller information. This means to complete the full name of the seller. The name must be PRINTED. So use only Capital Letters to write SELLER’S NAME. Then complete seller’s street address, seller’s city and state. Further you will need to fill out the Buyer information. Start with the full name of the buyer. The buyer’s name must be PRINTED. Likewise this means to use only Capital Letters to write BUYER’S NAME. Additionally fill out buyer’s street address, buyer’s city and state. After these details you have to write the sum of the transfer price of the vehicle or the word GIFT, if it’s the case. If the vehicle is a gift, please complete the relationship with the buyer (e.g. parent, spouse, friend) and fill the value of the vehicle:

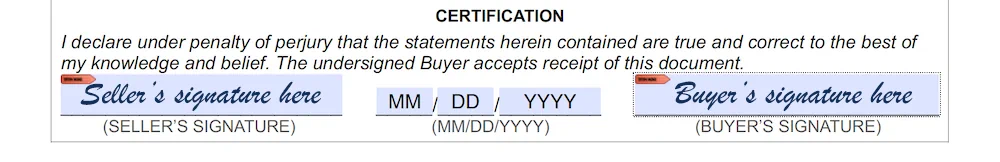

Section 3 of the North Carolina Bill of Sale

The third section is the seller’s certification about the details contained in this Bill of Sale. It also certifies the buyer’s acknowledgement. Finally, complete seller’s signature, date, and buyer’s signature:

Please note that you can fill out this Bill of Sale form by hand. However don’t forget to use a pen and not a pencil with blue or black ink. If you complete this form on your device (phone, tablet, computer) this form is a fillable PDF that works best with Adobe Acrobat Reader.

More details about a vehicle transfer in North Carolina

The Title Transfer requires an additional document to be provided. And this document is the original Title of the vehicle. Also the information on the back of the original Title must be filled out by both the original owner and the buyer. This information includes:

- Buyer/Recipient’s name & address;

- Date of sale or date of delivery;

- Seller’s signature & hand printed name;

- Odometer reading (if required);

- Notarization;

- Damage Disclosure Statement.

For vehicles purchased from an individual, complete these details as well:

- Vehicle Title;

- Notarization Required;

- Lien Release – Must be completed if any liens are shown on vehicle’s title.

- Title Application (MVR-1);

- Declare all liens, Notarization Required;

- Odometer Disclosure Statement (MVR-180) must be completed if the vehicle is model year 2011 or newer and below 16,000 pounds;

- Damage Disclosure Statement (MVR-181).

If a vehicle is transferred between husband & wife, parent & child or stepparent & stepchild, the recipient is exempt from the Highway Use Tax Exemption Certification MVR-613.

If the buyer/recipient fails to submit the request for title transfer within 28 days from the date of delivery or notary date (whichever is later), the owner will be subject to a late penalty!

View more about the North Carolina Department of Transportation

For more information go to North Carolina Department of Transportation – North Carolina Division of Motor Vehicles.

North Carolina Department of Transportation is one of North Carolina’s largest state government agencies, with 12,000 employees. NCDOT provides high-quality transportation services for travelers throughout North Carolina, including highways, rail, aviation, ferries, bicycle and pedestrian facilities, and public transit.