In the State of Oklahoma when you transfer, buy or sell a vehicle you should always write a Bill of Sale form.

The Bill of Sale records specific transaction details and has legal value for both the buyer and the seller.

Even though the Oklahoma DMV doesn’t provide a state-approved Bill of Sale Form, you can download and print our Bill of Sale Form below.

The following information should appear on the Oklahoma Bill of Sale Form:

- Vehicle information with Vehicle Identification Number (VIN)

- Odometer reading at the time of transfer

- The sale price or vehicle value

- Name and address of the seller

- Name and address of the buyer

- Seller’s Signature

- Date of sale

- Buyer’s signature

Oklahoma Bill of Sale Form

Below you can find and download our updated Bill of Sale Form for 2024:

Click here to download the Oklahoma Bill of Sale Form.

How to complete the Oklahoma Bill of Sale Form

This Oklahoma Bill of Sale is composed of three sections and below you can learn how to fill this form:

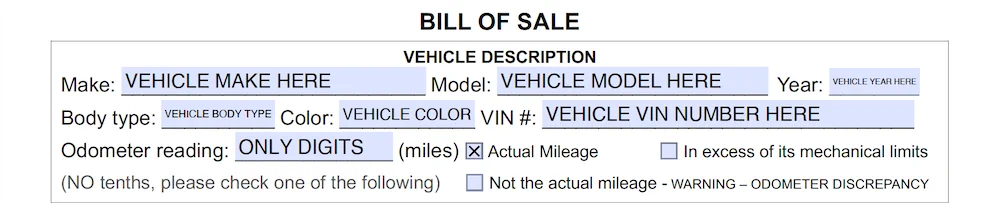

Section 1 of the Oklahoma Bill of Sale

The first section contains the vehicle information. Here you need to fill out the Make, Model, Year, Body type, Color, VIN or Vehicle Identification Number. Also fill out here the Odometer Reading at the time of transfer (use only digits, no tenths). Then check if this is the Actual Mileage. Or you may check if the Odometer is in excess of its mechanical limits. If it’s the case you may also check if the odometer reading is not the actual mileage:

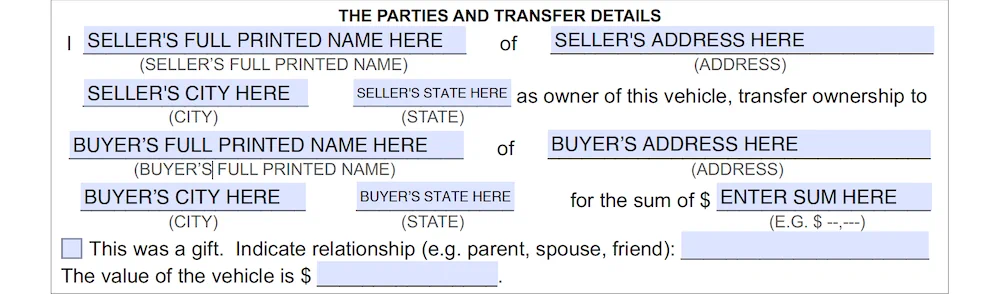

Section 2 of the Oklahoma Bill of Sale

In the second section you need to fill out first the Seller information. This means the full name of the seller. The name must be PRINTED – this means to use only Capital Letters to write SELLER’S NAME. Then fill seller’s street address, seller’s city and state.

Further you need to fill out the Buyer information. Start with the full name of the buyer. The buyer’s name must be PRINTED as well. This means to use only Capital Letters to write BUYER’S NAME. Additionally fill out buyer’s street address, buyer’s city and state.

After these details you have to write the sum of the transfer price of the vehicle, to indicate if this vehicle was a gift and the relationship with the person (e.g. parent, spouse, friend) and the value of the vehicle:

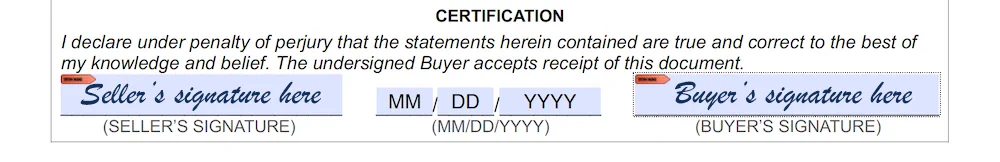

Section 3 of the Oklahoma Bill of Sale

The third section represents the seller’s statement about the details stated in this Bill of Sale. Finally, complete seller’s signature, date, and buyer’s signature:

Please note that you may fill this Bill of Sale form by hand also. However don’t forget to use a pen with black or blue ink and not a pencil. If you write this form on your device (phone, tablet, computer) this form is a fillable PDF. So this PDF file works best with Adobe Acrobat Reader.

More details about a vehicle transfer in Oklahoma

When you sell a vehicle you are required by law to state the mileage upon transfer of ownership. Failure to complete or providing a false statement may result in fines and/or imprisonment!

To complete an odometer disclosure statement use this form: Odometer Disclosure Statement – Form 729.

As a seller, for your safety, you can notify the Oklahoma Tax Commission of the assignment of new ownership of your sold vehicle by completing a Notice of Transfer of Ownership of a Vehicle – Form 773

A Bill of Sale form will not be sufficient if you wish to purchase a vehicle and the owner does not have a certificate of title. So to transfer the ownership of a vehicle, in addition, a negotiable certificate of title, properly assigned to the new owner(s), is required.

Oklahoma law provides that vehicle excise tax is based on the purchase price of a vehicle. This rule excludes any trade-in adjustment and provided the purchase price is within twenty percent (20%) of the average retail value for that model of vehicle. If the purchase price was not within 20% of the average, a taxable value is assigned equal to the nearest acceptable price within the value range for that model. In such situations, the taxable value may be higher or lower than the actual purchase price. This taxable value depends upon whether the price presented exceeded the highest or lowest limits of acceptable value for that model vehicle. Please note, no taxable value adjustment is made for the condition (mileage, damage, etc.) of a particular vehicle.

Download here the Declaration of Vehicle Purchase Price.

Details about the Oklahoma Motor Vehicle Division

For more information go to Oklahoma Tax Commission – Oklahoma Motor Vehicle Division.

The Motor Vehicle Division of the Oklahoma Tax Commission deals primarily with the titling and registering of vehicles. Vehicles include boats, outboard motors, manufactured homes, travel trailers and commercial trailers as well. The Division is located at 2501 Lincoln Boulevard in Oklahoma City. Motor Vehicle Division Phone Number (405) 522-7000.

Please be advised that the State of Oklahoma utilizes a statewide network of over 300 motor license agents or Tag Agents. Accordingly they have the capability of processing virtually any vehicle title and/or registration transaction, applying the identical tax and fee structure. To expedite your request, you may wish to visit one of these offices.