In the State of Tennessee you should fill an optional Bill of Sale form to record the sale or transfer of a vehicle.

As vehicles are bought and sold, the title is the legal documentation of each change in ownership.

Even though a vehicle’s title establishes who owns the vehicle, for your safety a completed Bill of Sale is also a good idea.

Also an optional Bill of Sale form serves as a legal contract between the seller and the buyer documenting the transaction.

The following information should appear on the Tennessee Bill of Sale Form:

- Vehicle details, including Vehicle Identification Number (VIN)

- Odometer reading at the time of transfer

- The purchase price or vehicle value

- Name and address of the seller

- Name and address of the buyer

- Seller’s Signature

- Date of sale

- Buyer’s signature

Tennessee Bill of Sale Form

Below you can download, complete and print our updated Bill of Sale Form for 2024:

Click here to download the Tennessee Bill of Sale Form.

It is important to mention that federal and state law require both seller (transferor) and buyer (transferee) to accurately state the mileage of any used motor vehicle, with a manufacture year of 2011 or newer, in connection with the transfer of ownership whether sale, trade-in or exchange.

Failure to complete or providing a false statement may result in fines and/or imprisonment!

So please don’t forget to complete the odometer reading on the Bill of Sale, on the title and separately if needed on the Odometer Disclosure Statement – F-1317001.

To explain and certify any discrepancies that may have occured regarding the odometer please complete an Odometer Discrepancy Statement – F-1310801.

To appoint an individual or entity to manage your vehicle transaction please complete a Power of Attorney for Vehicle Transactions – F-1311401.

How to complete the Tennessee Bill of Sale Form

This Tennessee Bill of Sale is composed of three sections. Below you can learn how you can fill this form correctly:

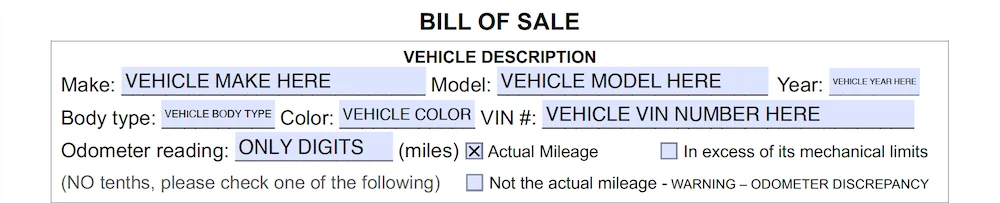

Section 1 of the Tennessee Bill of Sale

In Section 1 you have to complete the vehicle information. Here you need to complete the Make, Model, Year, Body type, Color, and VIN or Vehicle Identification Number. Also fill out here the Odometer Reading at the time of transfer (use only digits, no tenths). Then check if this is the Actual Mileage. Or check if the Odometer is in excess of its mechanical limits. If it’s the case you should check if the odometer reading is not the actual mileage:

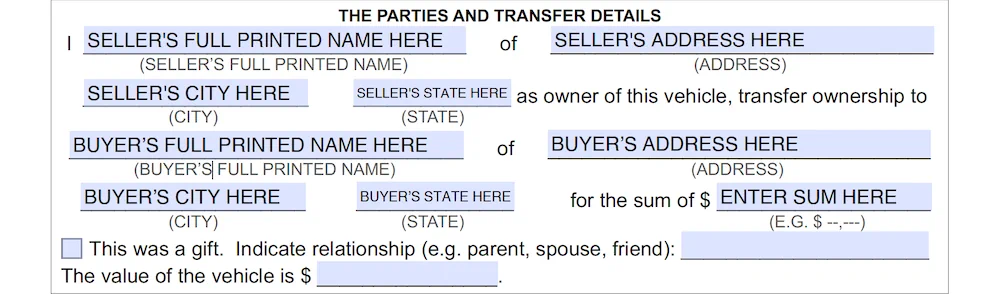

Section 2 of the Tennessee Bill of Sale

In the second section you have to complete first the Seller information. Start to complete first the full PRINTED name of the seller. This means to use only Capital Letters to write SELLER’S NAME. Then complete seller’s street address, seller’s city and state.

Further you need to fill out the Buyer information. Start with the full name of the buyer. The buyer’s name must be PRINTED. Again, this means to use only Capital Letters to write BUYER’S NAME. Then fill out buyer’s street address, buyer’s city and state. After these details you have to write the sum of the transfer price of the vehicle or the word GIFT. Finally if this vehicle was a gift please indicate the relationship (e.g. parent, spouse, friend) and the value of the vehicle:

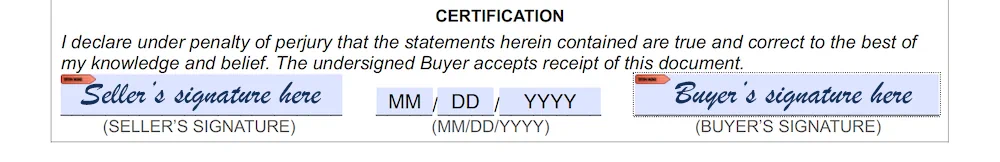

Section 3 of the Tennessee Bill of Sale

The last section represents the seller’s certification about the details stated in this Bill of Sale. Finally complete seller’s signature, date, and buyer’s signature:

Please note that you can fill this Bill of Sale form by hand. However don’t forget to use a pen with blue or black ink and not a pencil. If you complete this form on your device (phone, tablet, computer) this form is a fillable PDF that works best with Adobe Acrobat Reader.

Learn more about the Tennessee Vehicle Services Division

For more information go to Tennessee Department of Revenue – Tennessee Vehicle Services Division.

Tennessee’s chief tax collector, the Department of Revenue administers and collects taxes and fees associated with state tax and motor vehicle title and registration laws. Nonetheless this Department collects about 87 percent of total state tax revenue, along with taxes for local, county and municipal governments. Specifically the Department of Revenue apportions revenue collections for distribution to various state funds and local governments.

The Department of Revenue’s Vehicle Services Division provides motor vehicle title and registration services for passenger and commercial motor vehicles, motorcycles, ATVs, trailers and mobile homes.

Working with county clerks around the state, the Department registers more than six million vehicles and issues about two million new titles each year.