In the State of Texas when you sell or transfer a vehicle, you should complete also the optional Bill of Sale form for your safety.

This form serves as a legal contract between the seller and the buyer and it also documents the transaction. You can find below all the details and the form.

So a Bill of Sale Form is always useful if the seller or the buyer of a vehicle wants a record of the transaction. Also this form is helpful when the seller wishes to have a legal record or receipt of the sale or transfer.

To be valid the following details need to appear on the Texas Bill of Sale Form:

- Vehicle description, including Vehicle Identification Number (VIN)

- Odometer reading

- The purchase price or vehicle value

- Name and address of the seller

- Name and address of the buyer

- Seller’s Signature

- Date of sale

- Buyer’s signature

Texas Bill of Sale Form

Below you can download, complete and print our updated Bill of Sale Form for 2024:

Click here to download and print a generic Texas Bill of Sale Form.

How to fill the Texas Bill of Sale Form

Our free generic Texas Bill of Sale Form is composed of three sections. Below you can learn how to fill out this form in a few minutes:

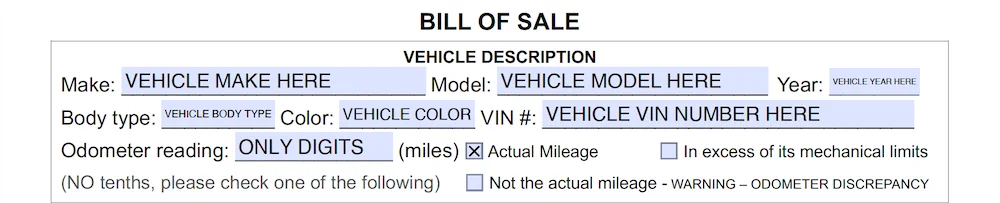

Section 1 of the Texas Bill of Sale Form

The first section contains the complete vehicle information. So fill out the Make, Model, Year, Body type or Style, Color, and VIN or Vehicle Identification Number. Next fill out the Odometer Reading at the time of transfer. Here use only digits, and no tenths. Next check if this is the Actual Mileage. Or you can check if the Odometer is in excess of its mechanical limits. If it’s the case you can check if the odometer reading is not the actual mileage:

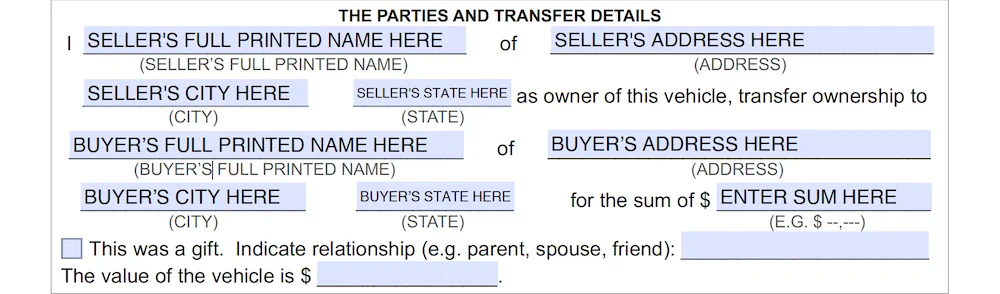

Section 2 of the Texas Bill of Sale Form

At the second section you have to complete details about the signing parties and the transfer. So first fill out the Seller information. This means to fill out the full name of the seller. The name must be PRINTED. So fill out with only Capital Letters the SELLER’S NAME. Then complete seller’s street address, seller’s city and state. Further you will need to fill out the Buyer information. So complete the full name of the buyer. The buyer’s name must also be PRINTED. Next fill out buyer’s street address, buyer’s city and state. After these details complete the sum of the transfer price of the vehicle (or the word GIFT). So if this vehicle is a gift, please indicate the relationship with the person (e.g. parent, spouse, friend) and the value of the vehicle:

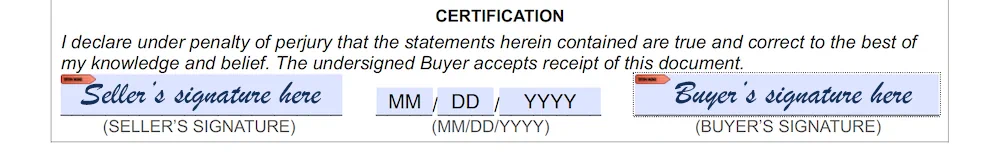

Section 3 of the Texas Bill of Sale Form

The last section represents the Certification. This is the seller’s statement and the buyer’s acknowledgement. Finally complete the seller’s signature, the transfer date and buyer’s signature:

Please note that you can fill out this Bill of Sale form by hand. For this purpose please use a pen with blue or black ink and not a pencil. If you are filling out this form on your device (phone, tablet, computer) this form is a fillable PDF. This form works best with Adobe Acrobat Reader.

Watch our video about the Texas Bill of Sale

More details about a vehicle transfer in Texas

Also remember that when you sell a vehicle you need to sign, date and enter the odometer reading on the back of the title. Sign the buyer’s application for title (Form 130-U) and write in the sales price. Keep your license plates because you may transfer them to your other vehicle. Next remove the windshield registration sticker. After the sale go to your local county tax office with the buyer to file the required paperwork. If you do not accompany the buyer to the county tax office, file a vehicle transfer notification.

Within 30 days of the vehicle’s date of transfer to help protect yourself from liability for criminal or civil acts involving the vehicle and the person(s) or entity taking ownership you need to submit this form: Texas Motor Vehicle Transfer Notification – Form VTR-346

Please note that you can submit this form also after 30 days and it will still be recorded.

We recommend, for your records, to also use this federal form to state the mileage upon transfer of ownership: Texas Odometer Disclosure Statement Form.

Tips for when you buy or sell a vehicle in Texas

As a buyer you need to get the vehicle title and have the seller sign, date, and enter the odometer reading on the back. Have the seller sign your application for title and write in the sales price. After the sale go to your local county tax office with the seller to file the required paperwork. Get a vehicle transit permit – you’ll need it if the previous owner kept the license plates. File your application for title in your name within 30 days from the date of the sale.

When a Texas-titled vehicle is sold or traded in, the seller needs to notify Texas Department of Motor Vehicles (TxDMV). By completing a Vehicle Transfer Notification you are notifying TxDMV that you have sold a vehicle. When you submit the form a remark will be added to the vehicle record which shows the date you sold the vehicle. This can protect you if the buyer fails to promptly transfer the title.

If you submit a transfer notification within 30 days of sale, the buyer shown becomes the vehicle’s presumed owner. In this case the buyer may be subject to criminal or civil liability for parking tickets, toll violations, fines or other penalties that occur after the date of sale.

Details when you transfer a vehicle in Texas

If you buy a vehicle from an individual, have the seller accompany you to the county tax office to avoid unwanted surprises. Before submitting the title application, a tax office representative can tell you if the title being signed over to you is correct and if it has any salvage or legal issues. You can also use Title Check to see if the title of the vehicle you are thinking about buying has any issues impacting its value.

In addition to the title, ask the seller to provide you with the signed vehicle title application, Form 130-U. Also request from the seller any other supporting documents, such as a release of lien or power of attorney. Keep a written record that includes the name and address of the seller, date of sale and vehicle information, including the VIN. Failure to title a vehicle within 30 days from the date of sale may result in delinquent transfer penalties.

You must provide proof of liability insurance when you title and register your vehicle. However if you do not provide proof of insurance, you may apply for ‘title only’ using Form 130-U, Application for Title Only.

More tips about transferring a vehicle in Texas

The Vehicle Inspection Report (VIR), which is proof of inspection, also must be provided if a record of current inspection is not in the state database. Ask the seller for a copy of the latest VIR if it is available.

If the transaction takes place on a Saturday or Sunday and the seller chooses to remove their license plates and registration sticker from the vehicle, you’ll need to download a Vehicle Transit Permit. This will allow you to legally drive the vehicle to the county tax office. If the county tax office is closed then to a place of your choice. This permit is valid for five calendar days and only one permit may be issued per vehicle sale.

If buying from an individual, a motor vehicle sales tax (6.25 percent) on either the purchase price or standard presumptive value (whichever is the highest value), must be paid when the vehicle is titled. The title, registration and local fees are also due. Contact your county tax office to estimate the amount of sales tax due and to learn which forms of payment are accepted. Acceptable forms of payment vary by county.

Your local County Tax Assessor-Collectors office may have a ready-to-use bill of sale for vehicles. Jefferson County has a bare-bones Bill of Sale, for example, that you can use in any county.

View more about the Texas Department of Motor Vehicles

For more information go to Texas Department of Motor Vehicles.

The Texas Department of Motor Vehicles (TxDMV) is a dynamic state agency. It is dedicated to customer service, consumer protection and the success of motor vehicle-related industries.

It is one of only a handful of state agencies that raises revenue for the state. For every $1 the agency spends, it returns more than $10 in state revenue. The funds are primarily used to build and maintain the state’s roads and bridges.

The TxDMV is overseen by a nine member, governor-appointed board that is the agency’s policy-making arm. Daily operations are overseen by the agency’s executive director.

Each year the agency registers almost 24 million vehicles. It also regulates vehicle dealers, credentials buses and big trucks for intrastate and interstate commerce. It issues oversize and overweight permits. And it also awards grants to law enforcement agencies to reduce vehicle burglaries and thefts.

The agency was created by the state legislature in 2009 and is operational since November 1, 2009.

The TxDMV mission is “to serve, protect and advance the citizens and industries in the state with quality motor vehicle related services”.