In the State of Utah it is important to complete a Bill of Sale form when you sell, buy or transfer a vehicle.

For the seller, the Bill of Sale provides proof that title of the vehicle has been legally transferred.

Similarly, for the buyer, the Bill of Sale form documents the purchase price of the vehicle for tax purposes.

The Utah Bill of Sale form should contain:

- Name of the buyer

- Name and signature of the seller

- Complete vehicle description, including the Vehicle Identification Number (VIN)

- Purchase price of the vehicle

- Signature of the seller and date

Utah Bill of Sale Form

Below you can find and download the latest state-approved updated Bill of Sale Form for 2024:

You can use this Utah Bill of Sale Form – Form TC-843, provided by the Utah DMV.

This Bill of Sale can be handwritten or typed/printed, but it should be in ink, not pencil.

Remember to make a copy of this Bill of Sale Form for your personal records!

How to complete the Utah Bill of Sale Form

The Utah Bill of Sale Form TC-843 is composed of three sections and below you’ll understand how to fill out this form:

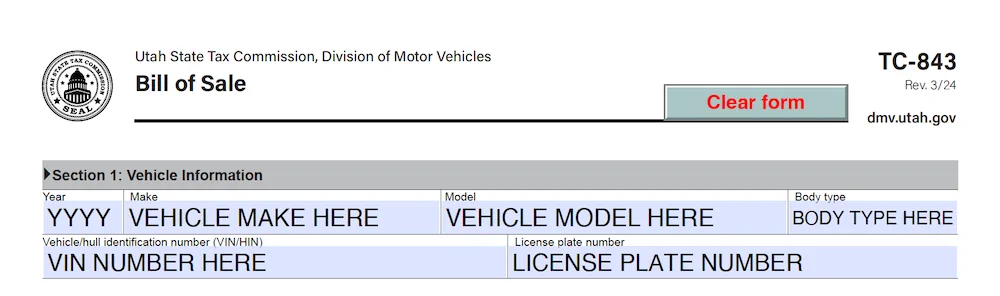

Section 1 of the Utah Bill of Sale

The first section contains the vehicle information. Complete here the vehicle’s Year, Make, Model, Body type, VIN or Vehicle Identification Number and License plate number:

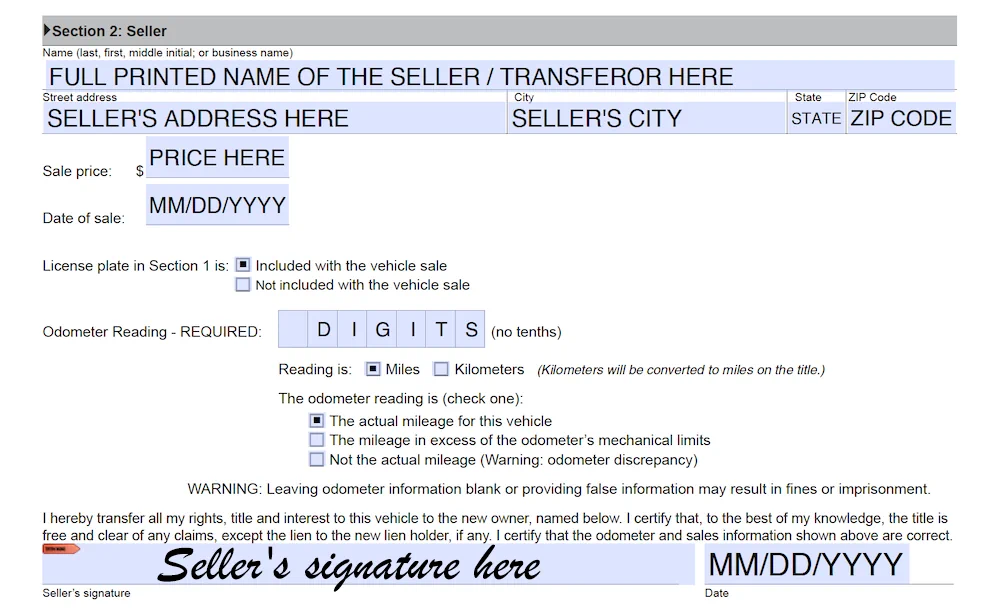

Section 2 of the Utah Bill of Sale

The second section contains seller’s details. So complete here first the full name of the seller. The seller’s name must be PRINTED. This means to use only Capital Letters to write SELLER’S NAME. Then fill in seller’s address, city, state and ZIP code.

Next fill in the sale price and the date of sale. After that check if the license plate is included or not with the sale of the vehicle.

Then fill the Odometer Reading at the time of transfer. Here use only digits, and no tenths. After that check if the reading is in Miles or Kilometers. Next check if this is the Actual Mileage. Or check if the Odometer is in excess of its mechanical limits. Only if it’s the case you may check if the odometer reading is not the actual mileage.

Do not leave the odometer information blank!

Lastly complete seller’s signature and the date:

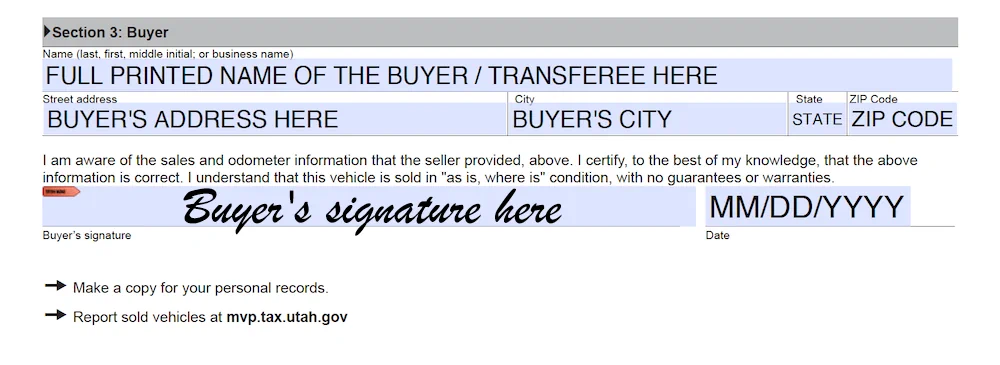

Section 3 of the Utah Bill of Sale

In the last third section complete buyer’s details. So fill here first the full name of the buyer. The buyer’s name must be PRINTED. This means to use only Capital Letters to write BUYER’S NAME. Next complete in buyer’s address, city, state and ZIP code.

Finally complete buyer’s signature and the date:

Please note that you can fill this Bill of Sale form by hand. However don’t forget to use a pen with blue or black ink and not a pencil. If you fill this form on your device (phone, tablet, computer) this form is a fillable PDF that works best with Adobe Acrobat Reader.

Selling a Vehicle in Utah

Things to check when you sell your vehicle in the State of Utah:

- Remove your license plates from the vehicle. If you do not, you may be liable for any parking or traffic violations occurring while your plates remain on the car.

- Give the new owner the signed title, current registration certificate, and current safety and emission certificates. The new owner may obtain a temporary permit from any Motor Vehicle office by presenting the signed title, proof of insurance, and picture identification and paying all applicable fees.

- Notify the Division of Motor Vehicles in writing that your vehicle has been sold. The notification must include the vehicle year, make, plate or vehicle identification number and the owner’s signature. This notification can be sent by fax or mail.

Utah law requires a seller to provide a title within 48 hours of the transaction, a common-sense approach is to obtain a title at the time of sale, or wait to pay for the vehicle until the seller can provide the title.

Without a negotiable title, you cannot title and register the vehicle in your name. A negotiable title is one that belongs to the vehicle being purchased. Check the make, model and compare the 17-digit Vehicle Identification Number (VIN) against the VIN on the car. And has been properly signed off by the seller.

If the title is in more than one person’s name (a husband and wife, or a co-signing parent, for instance), both may need to sign. If the title says, “John Doe and Jane Doe”, both must sign off on the title. However if the title lists “John Doe or Jane Doe,” only one must sign. No notary is needed to sign off on a title.

Buying a Vehicle in Utah

If a Utah title is lost, the buyer and the seller may fill out a Form TC-123, Application for a Duplicate Title. This document, properly completed, can then be used to register the vehicle in the purchaser’s name.

Be careful because Federal and State law require that you furnish to the transferee a written odometer disclosure statement upon transfer of ownership. For that reason failure to complete or providing a false statement may result in fines and/or imprisonment!

Both the seller and the buyer shall retain a legible copy of the odometer disclosure statement for not less than four years. So do not forget to complete a Form TC-891, Odometer Disclosure Statement filled out and signed by the owner and the buyer.

Particularly if the title shows a lien holder, you need to verify that the lien has been released.

Accordingly if the purchaser of the vehicle obtains a signed Bill of Sale from the seller of the vehicle, the amount of sales and/or use tax to be collected will be based upon the net purchase price shown on the Bill of Sale, if it contains the information described above.

All things considered if the buyer did not obtain a signed Bill of Sale from the seller (or the Bill of Sale does not meet the requirements described above), the DMV will calculate the amount of sales or use tax based upon the “Fair Market Value”.

Find more information about the Utah Division of Motor Vehicles

For more information go to Utah State Tax Commission – Utah Division of Motor Vehicles.

The Utah Division of Motor Vehicles is a division of the Utah State Tax Commission. The primary duty of the Utah DMV is to issue title and registration for Utah vehicles. In detail vehicles include all passenger vehicles, trucks, trailers, motorcycles, motor homes, off-highway vehicles, boats, and snowmobiles.