In the Commonwealth of Virginia you should complete a Bill of Sale form if the vehicle model year is more than 5 years old.

The Bill of Sale must be signed by both the seller and the buyer. Also the Bill of Sale should include the full vehicle description, vehicle identification number and date of sale.

Below you can find and use our updated Bill of Sale that contains all the necessary details to be legally valid.

Virginia Bill of Sale Form

Below you can find and download our updated latest Bill of Sale Form for 2024:

Click here to download the Virginia Bill of Sale Form.

How to fill a Virginia Bill of Sale Form

If the vehicle is a model year older than 5 years use this Virginia Bill of Sale Form. This form has three sections and below you can learn how to complete this form:

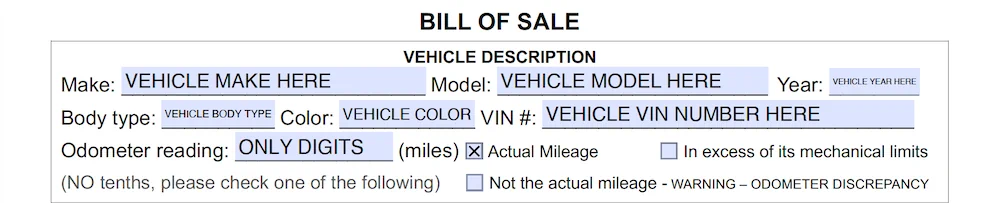

Section 1 of the Virginia Bill of Sale

Section 1 contains the vehicle information. Fill here the Make, Model, Year, Body type, Color, and VIN or Vehicle Identification Number. Next fill the Odometer Reading at the time of transfer (use only digits, no tenths). Then check if this is the Actual Mileage. Or you may check if the Odometer is in excess of its mechanical limits. If it’s the case you may also check if the odometer reading is not the actual mileage:

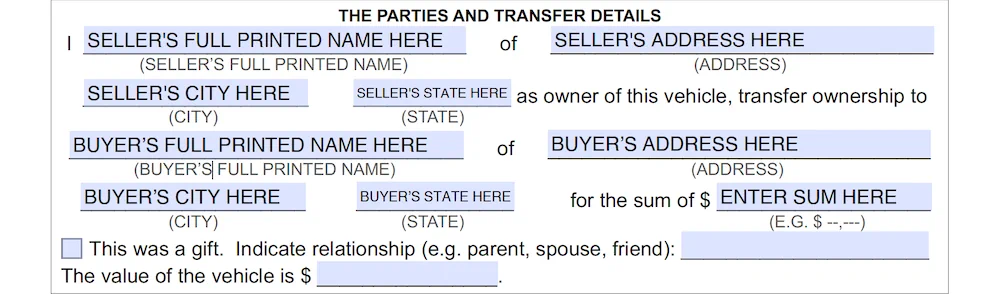

Section 2 of the Virginia Bill of Sale

At the second section you have to fill out first the Seller information. Start with the full name of the seller. The name must be PRINTED. This means to use only Capital Letters to write SELLER’S NAME. Then fill seller’s street address, seller’s city and state.

Further you need to fill out the Buyer information. Again, start with the full name of the buyer. The buyer’s name must be PRINTED. This means to use only Capital Letters to write BUYER’S NAME. Additionally fill out buyer’s street address, buyer’s city and state.

After these details you have to write the sum of the transfer price of the vehicle (or the word GIFT). Correspondingly, if the vehicle was a gift, you need to indicate the relationship with the buyer (e.g. parent, spouse, friend) and also fill the value of the vehicle:

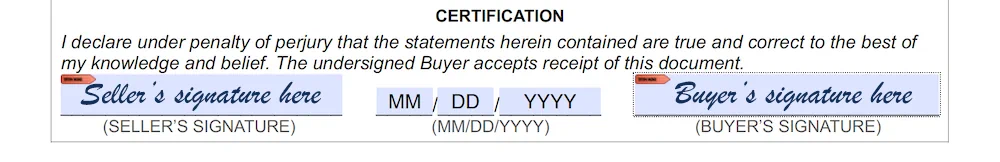

Section 3 of the Virginia Bill of Sale

The third section is the seller’s statement about the details stated in this Bill of Sale. Finally fill seller’s signature, date, and buyer’s signature:

Please note that you can fill this Bill of Sale form by hand. Don’t forget though to use a pen with blue or black ink and not a pencil. If you complete this form on your device (phone, tablet, computer) this form is a fillable PDF that works best with Adobe Acrobat Reader.

How to fill a Virginia SUT-1A Form

Effective July 1, 2015, unless exempted under Va. Code § 58.1-2402, Virginia levies a Motor Vehicle Sales and Use (SUT) Tax based on the vehicle’s gross sales price. An additional fee applies to electric vehicles, excluding mopeds.

The Motor Vehicle Sales and Use tax is collected at the time of titling whenever a vehicle is sold and/or ownership of the motor vehicle changes.

For a transaction between private individuals, the minimum Motor Vehicle Sales and Use Tax is calculated based on the trade-in value given in the NADA Official Used Car Guide. You may present either an Affidavit for Procurement of Title (SUT-1A) if the vehicle is 5 years old or newer (based on the model year).

In the case you need to transfer a vehicle that is less than 5 years old you need to fill out this Virginia Affidavit for Procurement of Title (SUT-1A) Form. This form is composed of three sections and below you’ll learn you how to fill out this form:

SUT-1A Form Section 1

Section 1 of the Affidavit Of Vehicle Purchase Price Form SUT-1A will be filled out with the vehicle information. Fill out Year, Make, Model, Body type, VIN or Vehicle Identification Number, Color and Sale Date:

SUT-1A Form Section 2

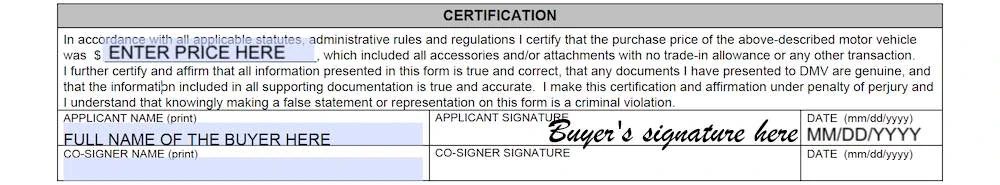

The second section is the certification of the vehicle purchase price. The certification is made under penalty of perjury. Please understand that knowingly making a false statement or representation on this form is a criminal violation! This section contains Applicant name or Buyer’s name. The name must be PRINTED. This means to use only Capital Letters to write BUYER’S NAME. Following fill out applicant’s signature and date:

SUT-1A Form Section 3

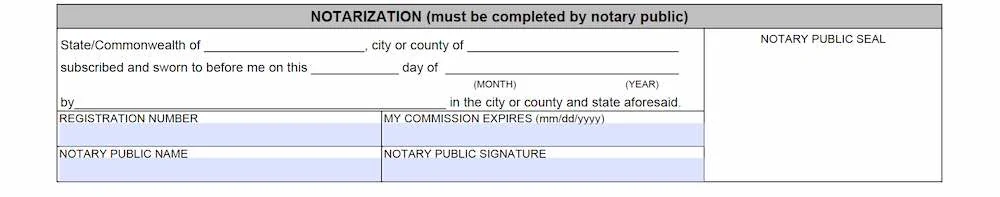

The last section is reserved for notarization. So it must be completed by notary public. DO NOT COMPLETE THIS SECTION!

Selling or Donating a Vehicle in Virginia

When you Sell or Donate a Vehicle:

- Sign your vehicle title over to the buyer/recipient. On the front of the title in Section A, sign your name, provide the name and address of the buyer/recipient and the odometer reading of the vehicle. If you are selling the vehicle, complete “Sales Price” which is also in Section A. If you are donating the vehicle, write “charitable gift” as the sale price on the title.

- Hand over the title to the buyer / recipient. Give the title to the buyer/recipient and ensure the buyer/recipient completes the title with name, address and signature.

- Remove your license plates from the vehicle. If you purchase a replacement vehicle, you may transfer your old plates to the replacement vehicle. If the plates are not transferred to another vehicle, you may return them to any DMV customer service center for recycling or destroy and dispose of them yourself. NOTE: If you have a full six months or more remaining in your vehicle registration period, you may qualify for a refund by returning the plates to DMV. Complete an Application for Vehicle Registration Refund Form (FMS-210) and mail it with the license plates to the address shown on the form. Be sure to contact Virginia DMV stating the plates are inactive. You may also request a refund by returning the completed FMS-210 and plates to a Customer Service Center or Virginia DMV Select.

- Notify Virginia DMV that you have sold, traded or donated the vehicle.

You must notify Virginia DMV that you have sold, traded or donated your vehicle. This may be accomplished by going online, visiting a customer service center or by phone. Notify the insurance company that you sold, traded or donated the vehicle.

Insurance Companies Notifications

Insurance companies notify Virginia DMV whenever they cancel, add or write new coverage for a motor vehicle. Therefore, if your insurance company cancels liability coverage on your vehicle because you no longer own it and you don’t notify DMV, the records will show that the vehicle is registered in your name but is uninsured. Since it is unlawful to have an uninsured registered vehicle, DMV may suspend your driver’s license and vehicle registration privileges!

You must notify the insurance company when you have purchased or received a vehicle as a gift. If you sold another vehicle, you may transfer insurance coverage to the new vehicle by providing the required information to the insurance company. Be sure to obtain liability insurance for the vehicle before you register it with DMV. Don’t forget also to transfer the old plates or purchase new plates for it.

Titling and registering a vehicle in Virginia

Ensure the vehicle is properly titled:

If you buy a new vehicle from a dealer, the dealer may process the proper title work and submit paperwork to DMV for processing. If you are buying a vehicle from an individual or the dealer is not handling the title work, ensure that Section A of the title has been completed, including the signature of the owner.

In the case you receive a vehicle as a gift or donation, ensure that Section A of the title has been completed. This includes the signature of the owner, and assure that “gift” appears as the sale price on the title. If the vehicle was donated or sold by a charitable organization, ensure the organization has provided a statement on the official letterhead stationery of the charity. This certifies that the charity is registered with the Internal Revenue Service § 501(c)(3) as a non-profit organization, and has not registered the vehicle. Visit your local DMV to title the vehicle.

Once your vehicle is titled, you may register your vehicle with DMV and pay the appropriate registration fees. You may either purchase new license plates or apply to transfer existing plates from another of your vehicles to the new vehicle and pay the transfer fee.

Ensure the vehicle has a valid safety inspection sticker!

Before operating a vehicle in Virginia, it must pass an annual safety inspection and display a valid safety inspection sticker. Trailers with separate braking systems must also be inspected.

If you need to visit Virginia DMV in person we recommend to make an online appointment here: Schedule an Appointment for Service

Discover more about the Virginia Department of Motor Vehicles

For more information go to Commonwealth of Virginia – Virginia Department of Motor Vehicles.

Virginia’s Department of Motor Vehicles (DMV) serves a customer base of approximately 6.2 million licensed drivers and ID card holders with over 7.8 million registered vehicles. DMV has more daily face-to-face contact with Virginia’s citizens than any other state agency. DMV also serves a wide array of businesses. Specifically it includes dealers, fuels tax customers, rental companies, driving schools, other state agencies, local governments and non-profit organizations.

Through its headquarters in Richmond, DMV operates 75 customer service centers, five mobile customer service centers, 57 DMV Selects. It operates also 13 permanent motor carrier service centers (weigh stations), 12 mobile weigh crews and three telephone call centers. Nonetheless it operates also automated telephone service, two DMV Connect teams, two mobile apps, and a website that offers more than 30 transactions.

DMV’s responsibilities include vehicle titling and registration, driver licensing and maintenance of driver and vehicle records. The agency also collects Virginia’s fuel tax, monitors the state’s trucking industry. It also serves as Virginia’s Highway Safety Office.

In addition, the agency effectively enforces motoring and transportation-related tax laws. The agency efficiently collects and distributes transportation-related revenues.